Alternative Capital

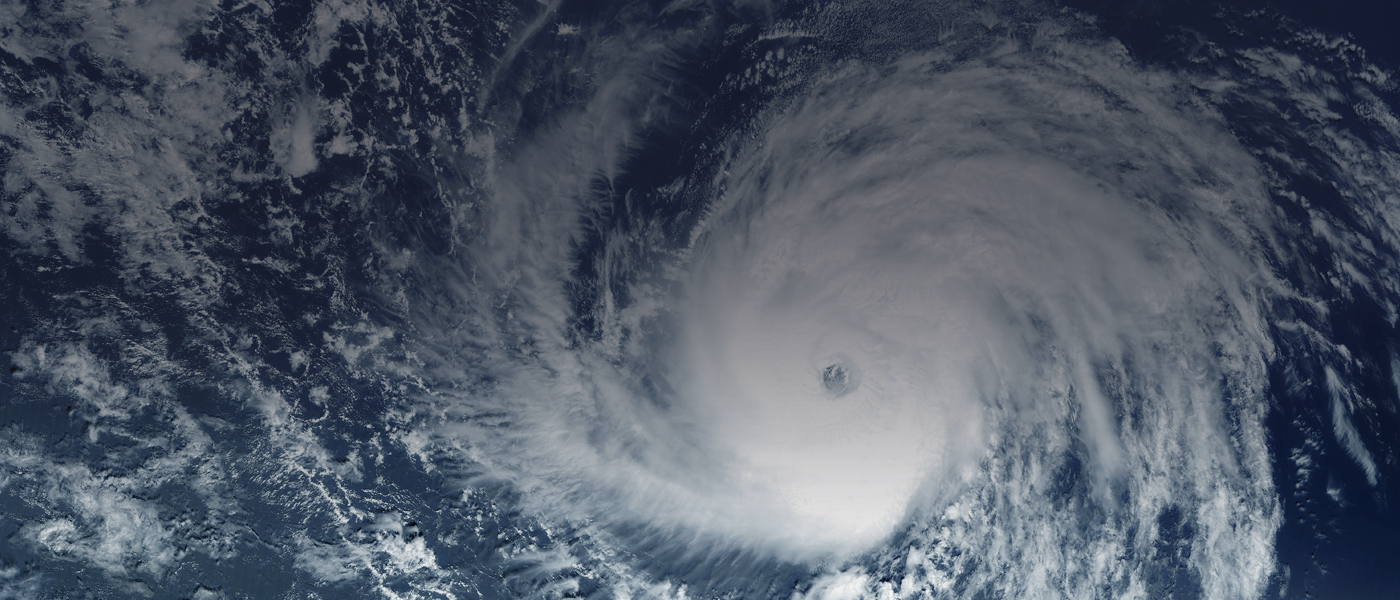

The emergence of a $30bn global marketplace for insurance-linked securities has served as evidence of the increasingly prominent role third-party capital now plays in risk transfer. Over the medium to long-term this sector is expected to continue its growth as investors take advantage of the low correlation insurance has with other asset classes. This section brings together Insurance Day’s coverage of alternative capital and the way it is helping reshape global insurance markets.

Hannover Re sponsors first cat bond to cover cloud outages

Reinsurer secures $13.75m of retro coverage through Cumulus Re issuance

American European completes inaugural catastrophe bond

Transaction provides three years of collateralised protection against named storms for coastal homeowners’ business written by MGU ShoreOne on American European’s behalf

Slide secures $210m in storm protection with Purple Re cat bond

Florida-based property insurtech sponsors its largest catastrophe bond to date

SageSure closes upsized Gateway Re catastrophe bond

Transaction provides $250m of collateralised protection against losses from named storms

Climate change to drive capital into reviving ILS market

ILS will continue to attract specialised investors, but cannot prevent some risks becoming uninsurable, experts say

Axis names Freeman as head of ILS

Bermuda-based carrier promotes Kyle Freeman to lead its insurance-linked securities development

Record 2023 ILS market tied to disciplined capital deployment: AM Best

Total insurance-linked securities market capacity estimated at around $100bn at the end of 2023, up $4bn for the year

Hamilton secures $200m in reinsurance through Easton Re catastrophe bond

Transaction will provide with three years of cover against losses from named storms in the US and its territories and earthquakes across North America

Fema secures $575m of collateralised reinsurance cover for NFIP

Transaction marks Fema's seventh foray into the catastrophe bond market for the National Flood Insurance Program

Heritage seeks $100m in storm cover with Citrus Re catastrophe bond

Bond will provide multi-year coverage against storm losses in Alabama, Georgia, Mississippi, the Carolinas and Florida

Cyber catastrophe bonds show potential for diversification: CyberCube

Losses ‘far less than perfectly correlate’ across the four recently issued 144A cyber catastrophe bonds, modelling firm says

RenRe to run off AlphaCat business

Property catastrophe-focused ILS investment business has already received redemption requests for ‘substantially all’ funds

You must sign in to use this functionality

Authentication.SignIn.HeadSignInHeader

Email Article

All set! This article has been sent to my@email.address.

All fields are required. For multiple recipients, separate email addresses with a semicolon.

Please Note: Only individuals with an active subscription will be able to access the full article. All other readers will be directed to the abstract and would need to subscribe.